Crew retention is the tip of the digital iceberg

Almost 12 months ago an ambitious project began to take shape. Roger Adamson of Stark Moore Macmillan, Vizada (now Astrium Services) and two of the largest crewing agencies in the world, Philippine Transmarine Carriers and CF Sharp, joined forces to embark on the most comprehensive survey of crew and their attitudes towards and use of communications at sea ever undertaken.

The resulting report has generated considerable interest. But while Adamson says it is encouraging to see so many shipmanagers and operators recognising the operational benefits of improved communications from a crew retention perspective, in this guest blog, he lays out why he believes there is a wider opportunity which comparatively few in the industry are really grasping.

Considering the enduring importance of crew retention it may seem surprising that until last year no organisation had commissioned definitive independent research into the communications requirements and habits of seafarers.

However, when confronted with the logistics of reaching, collecting and analysing the written, paper responses of almost 1,000 officers and ratings, this lack of comprehensive research becomes rather more understandable.

Key to any research project is the quality of the data and the sample. Had we not been working with PTC and CF Sharp which between them send over 47,000 crew each year to over 1,000 vessels in the commercial cargo and passenger sectors, it is unlikely such a survey would have been possible.

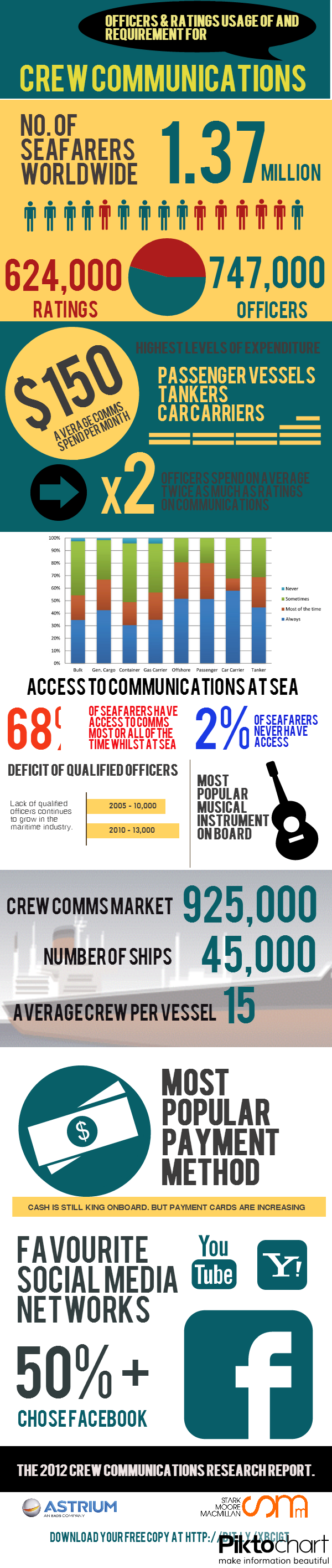

It certainly wouldn’t have produced such high quality data and responses. With the total market for satellite based crew communications estimated at approximately 925,000 individuals, our sample represents in the region of 1% of the market – making the dataset both fascinating and statistically significant.

One of the headline results has been that 68% of seafarers now have access to communications whilst at sea either all or most of the time with only 2% reporting that they never have access to communications. However those headline figures mask a wide variance between different sectors. For instance the passengership sector, despite having the highest levels of communications equipment on board, provides the lowest levels of free crew communications of any sector.

One of the headline results has been that 68% of seafarers now have access to communications whilst at sea either all or most of the time with only 2% reporting that they never have access to communications. However those headline figures mask a wide variance between different sectors. For instance the passengership sector, despite having the highest levels of communications equipment on board, provides the lowest levels of free crew communications of any sector.

In common with the passenger sector, offshore vessels have very high levels of equipment, but neither of these are principally driven by crew communications requirements. For the passenger sector, high-bandwidth communications systems are major revenue generators with the penetration of VSAT extremely high.

Similarly, the offshore sector is well penetrated with VSAT systems as charterer requirements dictate high-bandwidth be available, but in contrast to the passenger sector, offshore vessels offer far better access to free and paid-for communications, most likely a reflection of the scarcity of qualified offshore crew.

Across the sectors 46% of crew are not provided with any form of free communications at all. In the context of crew retention that figure should be raising eyebrows.

As a regular speaker at the Informa Manning & Training conference, where this year I’ve been asked to speak to delegates in Dubrovnik about crew communications, I consistently hear managers and operators wrestling with the issue of crew retention.

I’m repeatedly being told that the expense of training crew means that retaining them offers real dollar savings and competitive advantage. When one considers the noise VSAT has been making over the past several years it is curious that we are still in a situation where almost half of all seafarers have no access to free communications, when the ability to provide them with such would not only assist in their retention, but also offer broader opportunities to ship managers and operators.

I think this is where the real issues lie. Traditionally the expense of satellite communications together with the necessity for robust equipment and reliability in an environment where mission-critical literally equates to life and death, has always meant failure wasn’t an option and experimentation challenging.

As one of the most regulated industries in the world, shipping is about compliance and meeting minimum requirements. In many respects it is a unique industry, but it is not immune from the digital revolution which has swept up every other.

With the IMO advocating an over-arching e-navigation strategy combining ECDIS with new technologies converging across navigation, IT and communications, the landscape of maritime business is changing fast.

The opportunities for forward thinking ship managers and operators are highly significant, but unlocking maritime’s digital promise will require a major shift in thinking. IT, communications and digital technologies have the potential to drive cost savings, service improvements and the all-important crew retention.

In my experience shipmanagers and operators are hungry to understand how and where their businesses can implement and benefit from these changes, but as yet suppliers aren’t creating the cross-businesses value propositions to help them.

By commissioning the Crew Communications 2012 survey Astrium have signaled their intention to address this need. The wealth of information it has provided to shipmanagers and operators about the crew they depend upon is extremely valuable, but it’s only the beginning of what’s required.

Case studies have always been the primary tool in the maritime salesperson’s armoury, but what’s needed now are more independent, in-depth studies and analysis which can inform both suppliers, and ship managers and operators.

The advent of new High Throughput Satellite systems, from Intelsat EPIC to Inmarsat’s GlobalXpress, O3B to Iridium NEXT, means bandwidth and speeds will accelerate further. But without the context of operational implementation and potential cost efficiencies these systems are just adding a new level of complexity for ship managers and operators.

We are approaching an era of real technology convergence in maritime which has the potential to transform the industry for the better. Doing so will require technology suppliers to gain a far more holistic and in-depth understanding of the shipping business. And for ship managers and operators to help them.

A condensed version of the Stark Moore McMillan report, Crew Communications 2012 is available for download from here.